cash flow from assets formula

In a cash flow statement you will find information like. Free cash flow FCF is the money a company has left over after paying its operating expenses and capital expenditures.

Cash Flow From Assets Definition And Formula Bookstime

It is unreasonable to issue a check for such small expenses and for managing the same custodians are appointed by the company.

. Cash Flow Return on Assets. A general measure of the companys ability to pay its debts uses operating cash flows and can be calculated as follows. Cash Flow Statement Formula.

A change in free cash flow in a firm often provides a substantial idea about a firms performance. What is the Free Cash Flow FCF Formula. The formula is.

Net cash flow illustrates the amount of money being transferred in and out of a businesss accounts. Positive net cash flow indicates that a company can reinvest in operations pay expenses return cash to shareholders and pay off debt. A cash flow statement is a record of financial transactions over time.

A cash flow statement is one of the most important accounting documents for small businesses. The more free cash flow a company has the more it can allocate to dividends. There are a few different ways to calculate the cash flow coverage ratio formula depending on which cash flow amounts are to be included.

Let us take the example of a company DFR Ltd. Discounted cash flow is a method a company uses to evaluate the future returns on investments it makes. A cash flow statement is one of the quarterly financial reports publicly traded companies are required to disclose to the US.

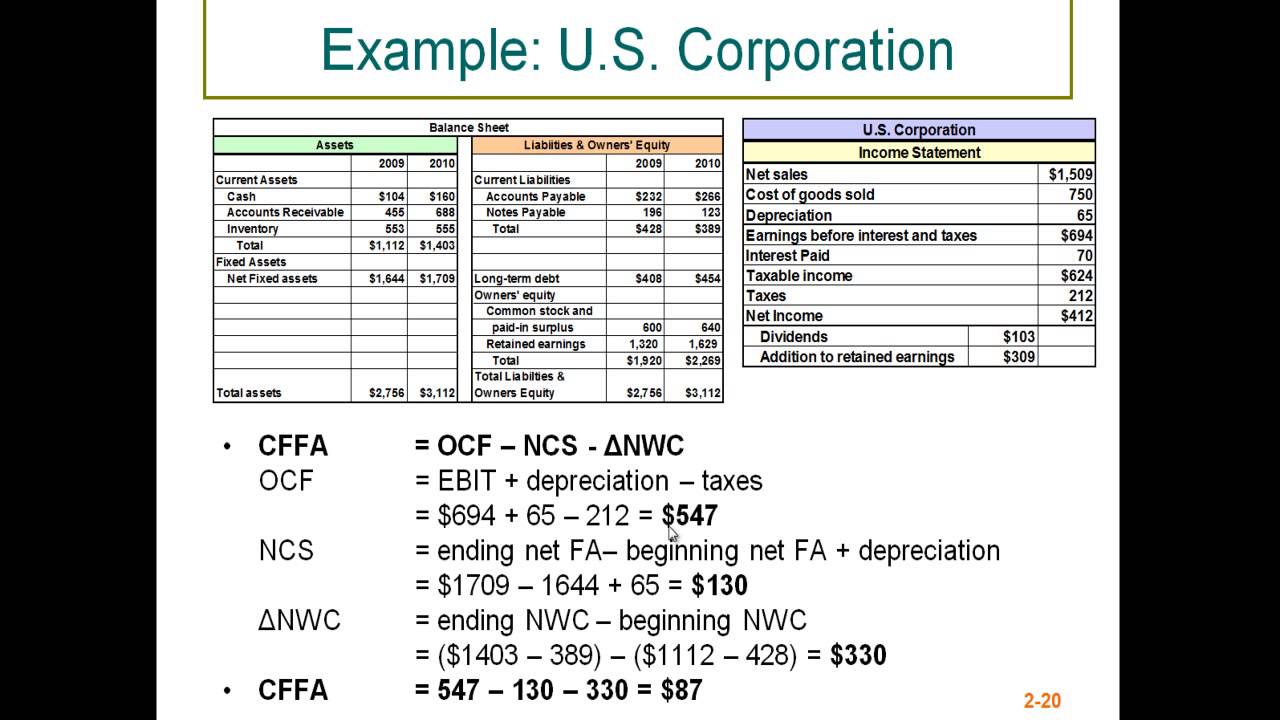

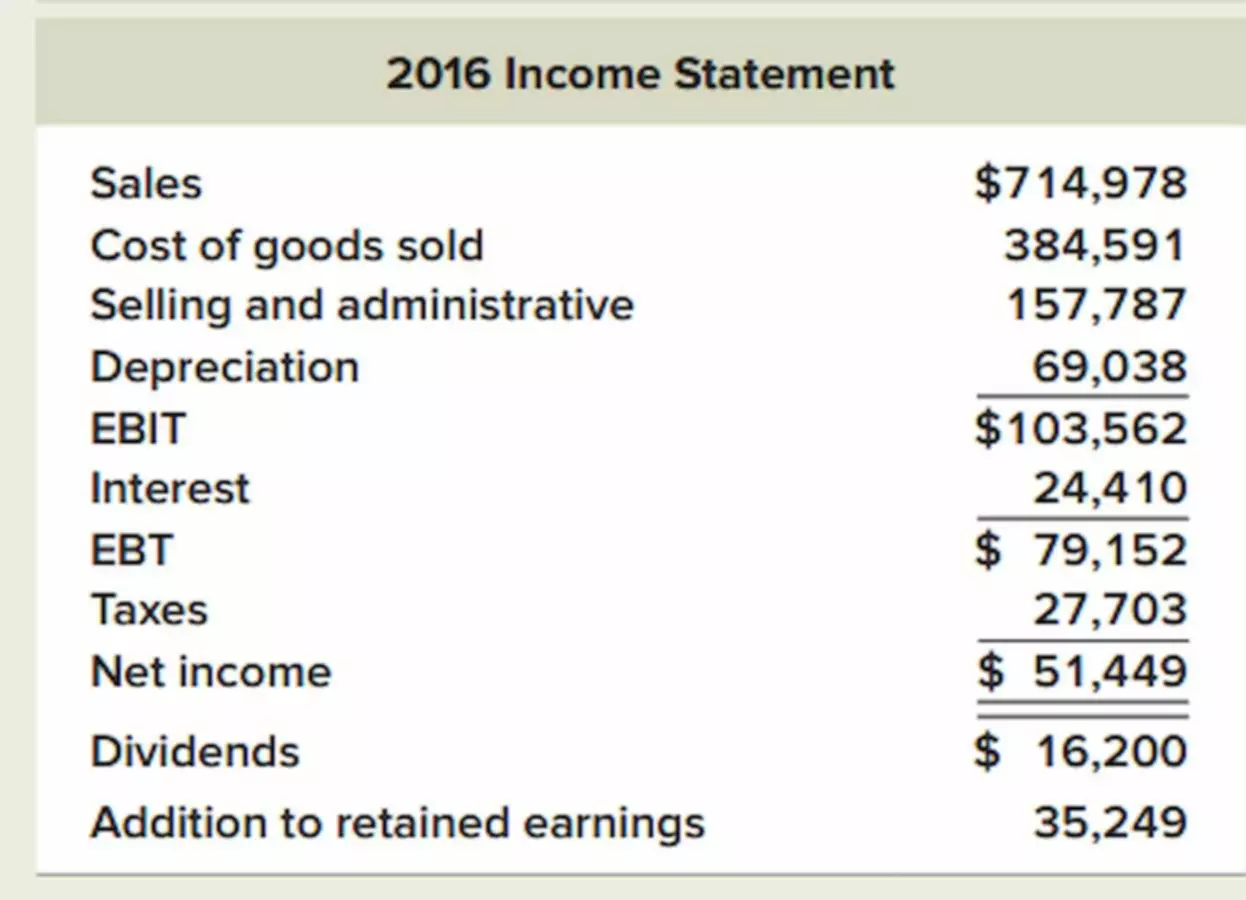

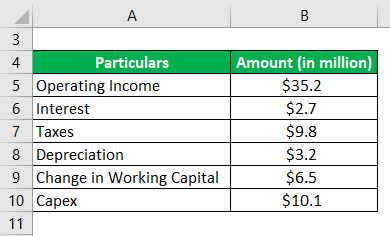

The senior management of the company wants to assess its cash flow during the year. Read more checking account Checking Account A checking account is a bank account that allows multiple. Firstly determine the operating income of the company from the income statement.

Which is in the business of manufacturing furniture. It is the income generated from the business before paying off interest and taxes. Significance of Free Cash Flow.

Free cash flow is considered to be an effective financial ratio which helps to gauge a companys proficiency and liquidity. Net profit Non-cash expenses Total net sales. When linked to a performance measurement system the likely result is a.

The finance department provided the following details about the cash flow during the year. The generic Free Cash Flow FCF Formula is equal to Cash from Operations minus Capital ExpendituresFCF represents the amount of cash generated by a business after accounting for reinvestment in non-current capital assets by the company. Likewise payments of cash for interest on loans with a bank or on bonds issued are also included in operating activities because these items also.

Cash comprises currency coins petty cash Petty Cash Petty cash means the small amount that is allocated for the purpose of day to day operations. Cash Flow Coverage Ratio Operating Cash Flows Total Debt. Net Cash Flow Formula Example 1.

Therefore OCF 500. The discounted cash flow formula offers a method for making accurate estimates about whether acquiring assets is beneficial or detrimental to business operations. Figure 122 Examples of Cash Flow Activity by Category Receipts of cash for dividends from investments and for interest on loans made to other entities are included in operating activities since both items relate to net income.

Any changes in the values of these long-term assets other than the impact of depreciation mean there will be investing items to display on the cash flow statement. Net cash flow illustrates whether a companys liquid assets are increasing or decreasing. Securities and Exchange Commission SEC and the.

In an asset-intensive industry it makes sense to measure the productivity of the large investment in assets by calculating the amount of cash flow generated by those assets. Cash flow from operations. Cash Flow from Investing Activities Example.

Suppose a company has a net income of 756 a non-cash expense of 200 and changes in asset-liability ie inventory is 150 account receivable Account Receivable Accounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment. Depending upon the change it either reflects a positive image or a negative image of. As you can see below investing activities include five.

Lets look at an example using Amazons 2017 financial statements. The formula for operating cash flow can be derived by using the following steps. Cash Flow Statement.

Capital Expenditure refers to fixed business assets like land and equipment.

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Line By Line Long Term Assets Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Cash Flow From Assets Definition And Formula Bookstime

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Formula Calculation With Examples

Operating Cash Flow Formula Calculation With Examples Otosection

Statement Of Cash Flows Ppe Net Versus Ppe Accumulated Depreciation Account Youtube

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow From Assets Definition And Formula Bookstime

Cash Flow To Assets Desjardins Online Brokerage